Guidelines and Principles

Financial Management

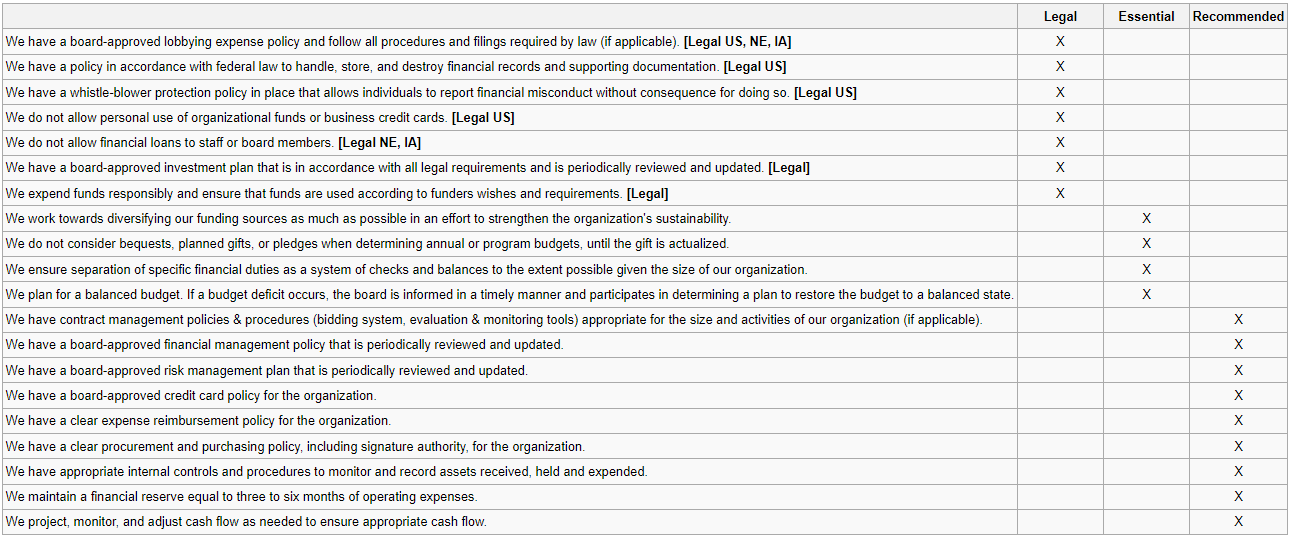

Nonprofits have an obligation to act as responsible stewards in managing their financial resources. Nonprofits must comply with all legal financial requirements related to financial matters. They should adhere to sound accounting principles that ensure fiscal responsibility and build public trust. Nonprofits should use their financial resources to accomplish their missions in an effective, efficient manner and should establish clear policies and practices to regularly monitor how funds are used.

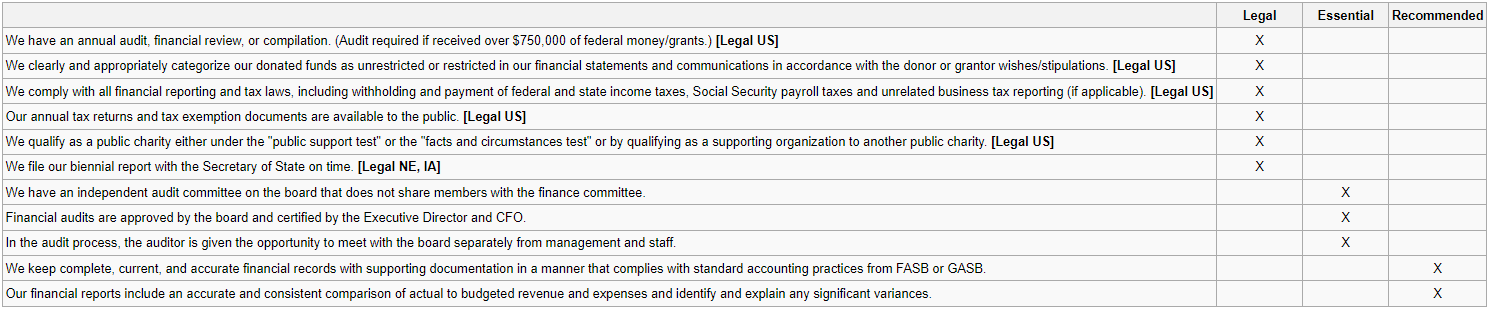

A nonprofit board member should clearly understand how to read and interpret financial statements and the audit or financial review reports. A nonprofit should keep complete, current, and accurate financial records with supporting documentation in a manner that complies with standard accounting practices from FASB or GASB. A nonprofit has a legal and ethical obligation to expend funds responsibly and must ensure that funds are dispensed according to the funders’ wishes and requirements.

Assessment Items

Policies & Plans

Reporting & Oversight

Resources

Legal

Appropriate categorization of donated funds US

Audit, if organization spends over $750,000 of federal money/grants (Office of Management & Budget Uniform Guidance; 990) US

Bulk-rate postage permit, if applicable US

Compliance with conditions placed upon donations (990) US

Financial records & destruction policy (Sarbanes-Oxley Act of 2002; 990) US

Financial supporting documentation—i.e., grant applications, sales slips, paid bills, invoices, receipts, deposit slips, canceled checks (Internal Revenue Code §501(c)(3)) US

IRS Form 1099-MISC, if applicable (Internal Revenue Code §501(c)(3)) US

Legal Information Institute: 26 USC § 4958 - Taxes on excess benefit transactions

Qualify as a public charity under “Public Support Test” or “Facts & Circumstances Test” (Revenue Code §170(b) (1) (A) (VI), §509(a) (1); 990) US

Unrelated business income tax (UBIT) reporting, if applicable (Internal Revenue Code §501(c) (3)) US

Whistleblower policy (Sarbanes-Oxley Act of 2002; 990) US

Lobbying expense policy & procedures, if applicable (Lobbying Disclosure Act of 1995; Neb. Rev. Stat. §49-1483.03; Iowa Code §68B.37; 990) US, NE, IA

Payroll—federal, state & local quarterly withholding/filings US, NE, IA

File biennial report (by April 1st, in odd years) with Secretary of State (Neb. Rev. Stat. 21-125;Iowa Code 504.1613) NE, IA

Prohibition on loans to board members/officers (Neb. Rev. Stat. §21-1988; Iowa Code §504.834) NE, IA

Essential

Accounts receivable and billing procedures

Asset & cash management policies & procedures

Audit, financial review, or compilation

Board review & approval of budget

Board review & approval of tax filings & audits

Budgets (revenue/expenses)

Cash disbursements—accounts payable procedures

Credit card policy & procedures

Directors & officers liability insurance

File tax exemption on personal property of the organization. Check with your county to see if applicable.

(http://www.dcassessor.org/faq-help)

Monthly financial statements with balance sheet

Procurement & purchasing policies

Signature authority

Best Practices

Polices & Plans

- While each board must determine the appropriate budget needed to achieve its mission, various industry benchmarks provide target ranges of 65-80% of expenditures for programs, and 20-35% for administration, fundraising and evaluation. Consider your own industry benchmarks when determining this balance.

- Monitor the cost of managing multiple funding sources and the overall ratio of the benefit vs. services delivered. A $10,000 program grant that costs you $7,500 to manage may not be worth the investment of staff time.

- Before a crisis occurs, discuss contingency options for the event of a budget deficit. Investigate a line of credit, and determine which programs/services could be minimized or temporarily discontinued if cost-cutting measures are needed.

- In your annual fund development planning, develop a strategy to build a reserve fund to sustain your operations during low cash-flow months and to provide for program expansion and enhancements.

- Develop a policy and procedures regarding the acceptance and valuation of gifts of property to the organization.

Reporting & Oversight

- Frame financial reports with relevant data points for comparison. A simple monthly statement of revenue and expenditures means nothing if not put in the context of year to date projections vs. actual activity. Explain variances in a relative context as well: a variance of $10,000 is worth consideration and deliberation if it equals 30% of your total budget but demands less attention if it represents 3% of a line item. Accuracy is important, but numbers put in context are too.

- Ensure that your board members are trained to read and understand your financial statements. They are legally accountable for your organization’s finances and it is your mutual responsibility to make sure they can fully meet their obligations.

- If appropriate, identify a legal expert with nonprofit experience to help you investigate and understand the difference between fiscal agency and fiscal sponsorship before engaging in such a relationship.