Guidelines and Principles

Transparency & Accountability

As entities that serve the public, nonprofits have an ethical obligation to conduct their activities in a way that is accountable and transparent to their constituents. Nonprofits should engage in ongoing efforts to openly convey information to the public about their missions, activities and decision-making processes. This information should be easily accessible to the public and should create external visibility, public understanding and trust in the organization.

Assessment Items

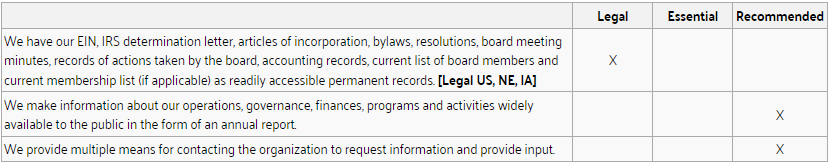

Accessibility & Public Information

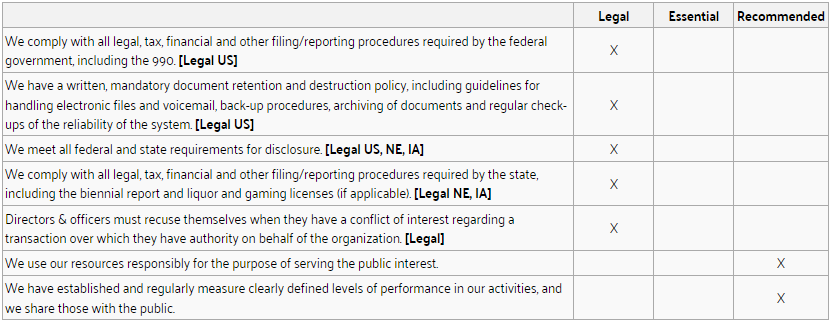

Accountability

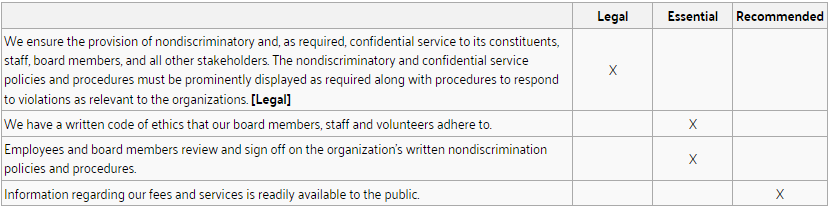

Fairness & Equity Practices

Resources

Legal

- Compliance with legal reporting, tax law, financial requirements (Internal Revenue Code §6033; 990) US

- Obtain Employer Identification Number (EIN) from the IRS. US

- Document retention & destruction policy (Sarbanes-Oxley Act of 2002; 990) US

- IRS Form 1023 & IRS determination letter, publicly available US

- IRS Form 990 and variants US

- Whistleblower policy (Sarbanes-Oxley Act of 2002; 990) US

- Articles of incorporation (Neb. Rev. Stat. §21-1921, §21-1922; Iowa Code §504.202 Minimum Code Requirements) NE, IA

- File biennial report (by April 1st, in odd years) with Secretary of State (Neb. Rev. Stat. §21-125; Iowa Code §504.1613) NE, IA

- Obtain liquor license (Neb. Rev. Stat. §53-138.03; Iowa Code §123.30(3) (a)) NE, IA

- Nebraska: When Do I Need A Liquor License?

- Nebraska: Get Info/Apply for a License

- Iowa: Get Info/Apply for a License

- Obtain gaming license to conduct bingo, a lottery by the sale of pickle cards, a lottery with gross proceeds in excess of $1,000, or a raffle with gross proceeds in excess of $5,000. (Neb. Rev. Stat. §9-232.01(1) (2); Neb. Rev. Stat. §9-424(1)) NE

- Obtain license for games of skill and chance, bingo operations, raffles, and social gambling activities from the Iowa Department of Inspections & Appeals, Social and Charitable Gambling Unit IA

- Professional commercial fundraisers must register with the Iowa attorney general and obtain a registration permit. May be required to update registration quarterly. (Iowa Code §13C.2) IA

- Be prepared to provide financial disclosure information to any person requesting it (Iowa Code §13C) IA

- Be aware of the requirements for sales tax/exemptions, as it varies from state to state.

- Iowa has a very broad policy of exempting nonprofits from taxes and Nebraska exempts very few.

- Iowa rules: https://tax.iowa.gov/iowa-tax-issues-nonprofit-entities

- Nebraska rules: http://www.revenue.ne.gov/info/7-215.pdf

Essential

- Annual report (publicly available)—including program information, organizational performance, financial status, donor (with permission), board & staff listings, organization contact information

- Code of ethics

- Nondiscrimination policy

Recommended

- Confidentiality policies & procedures (all constituents)

- Meeting agendas & descriptions of significant decisions made by the board of directors (publicly available)

- Information about fees & services provided (publicly available)

Best Practices

Accessibility & Public Information

- Develop a marketing and community relations strategy that keeps key constituencies informed: governmental units, donors, for profit and nonprofit organizations. Share annual reports, newsletters and media releases with targeted individuals.

- Develop a communications strategy to keep in contact with community members and key groups/organizations. Invite them to focus groups or town-hall meetings to discuss community needs and gain input on your work. Establish a context of partnership and stewardship of community resources.

Accountability

- A nonprofit must meet all federal requirements for public disclosure. These requirements state that a nonprofit must provide the last three years’ information returns (Form 990 or its variants), as follows:

- Public access must be provided immediately on request by allowing inspection of the documents at the organization's office or offices;

- Copies of the documents must be provided within 30 days upon written request;

- Organizations that make their materials widely available through publication on the Internet do not have to provide copies;

- If the IRS determines that the organization is being subjected to a harassment campaign, copies do not have to be provided; and 501(c)(3) organizations not classified as private foundations are not required to publicly disclose the list of names and addresses of individual contributors and may block out that section of Form 990 and other materials for public viewing.

Fairness & Equity Practices

- Review core values and principles of other organizations and discuss models that may reflect your organization’s values; develop and adopt (through a retreat or sub-committee) values and principles and then integrate them into all conversations regarding policy and program. Answer key questions such as:

- What practices are ethically acceptable?

- Are there funding sources that would create negative perceptions about our work?

- How will staff be best utilized in achieving our goals/mission?

- Are volunteers an important part of how we want to deliver services?

- Research and adopt good practices recognized within your field of service. Share these practices with other organizations to generate a professional standard.

- Review and consider Codes of Ethics for your industry. Allow your board to discuss formal adoption of a particular code, or the development of a hybrid code unique to your organization.