Guidelines and Principles

Fundraising

Nonprofit organizations play an important societal role in serving as the vehicles by which philanthropy occurs. Nonprofits act as the intermediaries between donors and beneficiaries and have ethical obligations to ensure proper handling of funds to carry out their missions. Nonprofit fundraising should be conducted according to the highest ethical standards with regard to solicitation, acceptance, recording, reporting and use of funds. Nonprofits should adopt clear policies for fundraising activities to ensure responsible use of funds for designated purposes and open, transparent communication with donors and other constituents.

A nonprofit should only seek funds that it needs to reasonably work toward achieving its mission over the foreseeable future and that will not bring about adverse conditions for constituents.

A nonprofit should use funds according to donor intent and comply with specific conditions for donations.

Nonprofits should not share or trade donor names with others unless given permission by the donor.

Assessment Items

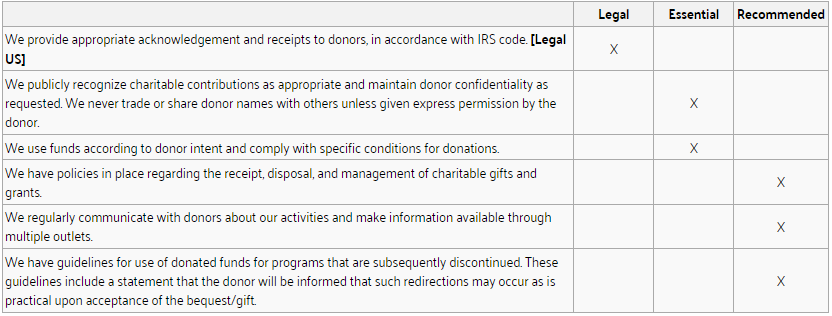

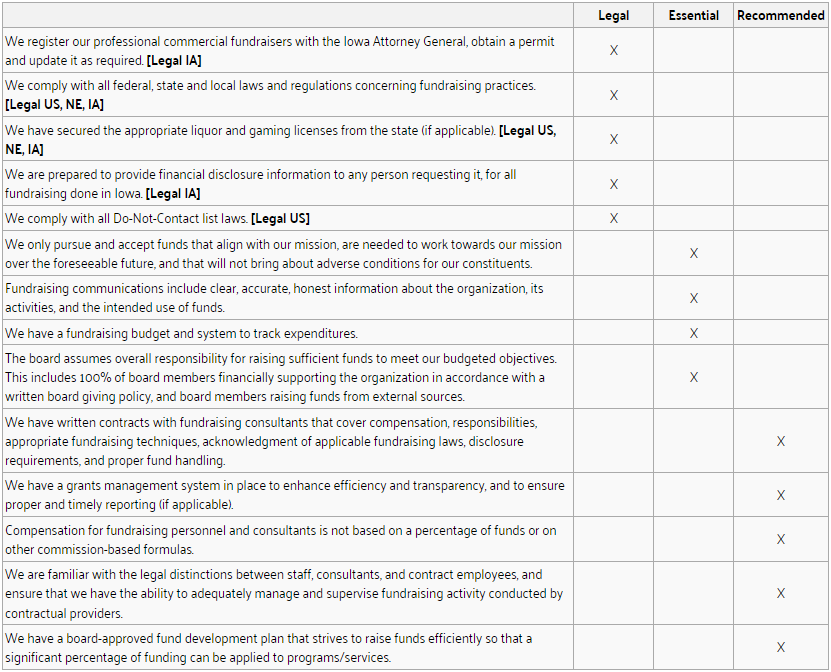

Accountability to Donors

Ethics, Responsibilities & Policies

Resources

Resources

- IRS.gov: 4.76.51 Fundraising Activities

- IRS.gov: Instructions for Schedule G

- National Council of Nonprofits: Fundraising Guidelines

Acknowledging Gifts & Contributions

IRS regulations require that before a donor may claim a tax deduction for a charitable contribution the donor must have a bank record or a written communication from the charitable nonprofit. That requirement is why donors expect a nonprofit to provide a receipt for their contribution. According to the IRS regulations, the donor is responsible for obtaining the written gift acknowledgment for any single contribution of $250 or more.

When a donor gives a contribution in excess of $75 and also receives something of value from the nonprofit in return (there is an exception for "token" gifts) the nonprofit is required to provide the donor with an explanation of the fair market value received in return for the donation. (The details are explained in the section on "quid pro quo" gifts below).

Regardless of the regulations, donors expect to receive a ‘thank you’ for their contributions regardless of the amount. Many fundraising professionals suggest sending the acknowledgment within a short period of time, which reassures the donor that the donation was received and boosts donor relations. Being prompt and making the message as personal as possible is most effective, especially when followed up by a report or personal message describing the difference the donor’s gift has made. It’s helpful to have a template ready to send out that can be customized as needed when donations arrive.1

Determining Fair Market Value

Donations don’t always come in cash or checks. Some donations are in the form of stock, land and other types of property. Statement of Financial Accounting Standards (SFAS) 157, issued in September 2006, provides a framework for nonprofits to apply to measure fair value.2

Income Approach

Income approach uses valuation techniques to convert future amounts to a single present amount, based on the value indicated by current market expectations about those future amounts. The focus is on future benefits generated by the subject business or asset, typically after-tax cash flow. Benefits are discounted to present value using an appropriate rate of return, or the “discount rate.”

Cost Approach

Cost approach is based on the amount that currently would be required to replace the service capacity of an asset. The focus is on the cost of reproducing or replacing the asset. The value of an asset should not exceed the cost to obtain a substitute asset of “comparable utility.”

Market Approach

Market approach uses prices and other relevant information generated by market transactions involving identical or comparable assets or liabilities. The focus is on the application of valuation metrics obtained from market transactions to the data of the subject business or asset, requiring valuation multiples derived from similar transactions.

Resources & Sample Documents

General Guides

National Council of Nonprofits: Acknowledging Gifts and Contributions (BROKEN LINK)

IRS.gov: IRS Publication 1771, Charitable Contributions–Substantiation and Disclosure Requirements

Payroll Deduction Contributions

IRS.gov: Recordkeeping Requirements for Charitable Contributions Made by Payroll Deduction

Quid Pro Quo

IRS.gov: Quid Pro Quo GiftAcknowledgments

Non-Cash Contributions

IRS.gov: Substantiating Non-Cash Gifts

Vehicle Donations

IRS.gov: A Charity's Guide to Vehicle Donations

Charity Auctions

SEE ALSO: Charitable Gaming: Nebraska

SEE ALSO: Sales & Use Tax: Nebraska

IRS.gov: Charity Auctions

Best Practices

Accountability to Donors

- Develop an annual Fund Development Plan that addresses all programs, projects, and services.

- Establish a Fund Advancement Committee to develop key strategies and cultivate needed resources.

- When seeking new/expanded funding sources, include all related costs and research any limitations or exclusions (i.e., some funders limit expenditures for equipment or technology expenses).

Ethics, Responsibilities & Policies

- Be familiar with industry standards for ethical fundraising (www.afpnet.org) and ensure that your employees, volunteers, and consultants are both aware of and compliant with these principles.

- In Iowa, visit the Attorney General’s web site https://www.iowaattorneygeneral.gov/ and review the rules and regulations for charitable solicitation and licensure of fundraising professionals.

- Iowa - Attorney General Licensing

- Iowa - Social and Charitable Gambling

- There is no required registration of fundraisers in Nebraska, but gaming laws apply.

- Assure that all board members are clear on expectations for their individual financial support as well as the board’s role in supporting fund advancement strategies through personal solicitations and relationship building.